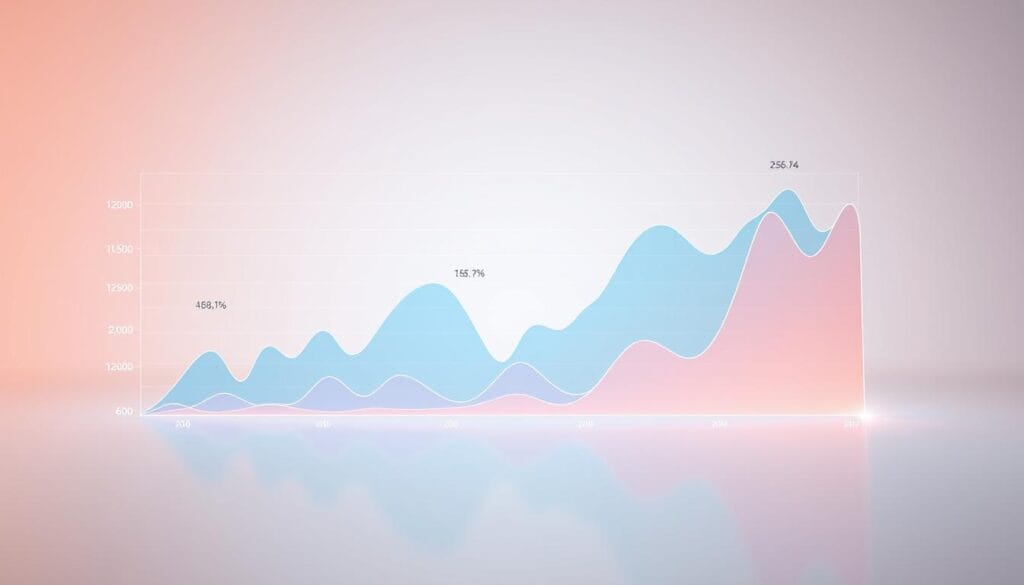

Fact: Google’s top-of-page bids for some money-related searches exceed $200 in the United States, with terms like Investment Banking Services hitting $258.04.

We know that when lifetime value is massive, every click becomes a battleground. That pushes cost per click far beyond average ranges and forces smart teams to win with precision, not bigger budgets.

We frame the core problem clearly: auction prices rise because intent maps tightly to revenue, and poor landing pages blow acquisition costs up per click.

Our approach uses recent Google Ads Planner search and search volume data to cut noise and give leaders a repeatable playbook.

Read on for intent mapping, funnel segmentation, and landing offers that turn expensive clicks into scalable revenue. We run measurement that tracks revenue, not vanity metrics, and we partner to engineer measurable ROI.

Key Takeaways

- Some bids for money-related searches top $200; winning needs precision over spend.

- Match intent for each funnel stage to reduce wasted cost per click.

- Use Google Planner search data and search volume to inform bids and creative.

- Optimize landing pages to raise conversion rates from 2% to 20–30%.

- Measure revenue outcomes, not just impressions or search metrics.

- Macro trends like privacy and AI require tighter controls and local bidding strategies.

The high-stakes truth behind expensive finance search terms in the United States

Top‑of‑page bids in competitive niches are not accidents; they reflect concentrated demand and clear revenue paths.

When people search with urgent intent, auctions compress. A narrow pool of buyers competes for a small set of terms and that drives prices up.

Google Ads Keyword Planner lists Investment Banking Services at $258.04 and Fast Invoice Factoring at $199.41 as top‑of‑page bid examples in the U.S..

Why bids can spike above $200

We see three forces at work.

- Intent density: transactional queries concentrate value on a few keyword clusters.

- Lifetime value: when a business has 5–7 figure LTV, $100–$250 cost per click is rational.

- Ad ecosystem signals: top‑of‑page bid is a ceiling indicator, influenced by ad rank, quality, and bid strategy — not the guaranteed per click price.

“Third‑party scrapes can misstate actual spend; use Google Planner for reliable search volume and bid context.”

| Search Term | Top‑of‑Page Bid (USD) | LTV Signal | Recommended Funnel |

|---|---|---|---|

| Investment Banking Services | $258.04 | Very high | Bottom‑funnel / direct contact |

| Fast Invoice Factoring | $199.41 | High | Transactional / apply flow |

| Attorney (city) | $60–$1,090 (report variance) | Medium–High | Leads / consult booking |

| Insurance & Mortgage | $80–$220 | High | Quote + remarket |

We advise treating premium placements as reserved inventory for bottom‑funnel keyword clusters. With finite search volume, segmentation and landing page rigor decide whether you scale or burn cash.

What drives CPC inflation for loans and EMI queries

Search auctions price access to customers who can change a company’s revenue curve overnight.

At the core is simple unit economics. When a business can earn large lifetime value from a single client, paying more per click becomes rational.

Google Ads Planner confirms this with real ranges: Credit Line for Businesses ($142.30), Company Credit Line ($130.80), Structured Settlement Loan ($105.20), and Business Loan ($71.34).

Industry economics: why higher bids make sense

Strong LTV, cross-sell paths, and management fees turn each paid lead into an investment rather than an expense.

Verified data over myths

We rely on Google Ads Planner to set realistic expectations. Third‑party scrapes often misstate search volume and bid ranges, which inflates forecasts and wastes budget.

Intent density: transactional vs informational

“Loan” searches typically sit at the bottom of the funnel. These people convert faster and justify premium spend per click.

EMI and payment explainers skew mid‑ to top‑funnel and need nurture sequences to become revenue.

Geo and urgency premiums

City, “near me,” and time qualifiers concentrate demand. Those modifiers create pockets of the highest cpc where advertisers compete for immediate need.

- Action: segment bids by geo, device, and hour to prioritise urgent search queries.

- Governance: run controlled tests that measure revenue per click, not impressions.

“Treat premium search placements as acquisition inventory—measureable, testable, and tied to revenue.”

Loans vs EMI: a list-style breakdown of keyword intent, funnel fit, and cost

We separate search intent into tight lanes so budget follows users who are ready to act. Below is a concise map that ties search behavior to funnel stage, creative, and bid priority.

Bottom-funnel converters

Immediate application intent. These search terms drive direct acquisition when your page removes friction.

- “business loan” — convert with simple forms and clear rates; expect strong top-of-page bids (Business Loan $71.34).

- “structured settlement loan” — requires proof and quick approvals (Structured Settlement Loan $105.20).

- “credit line for businesses” — prioritize fast underwriting and clear limits (Credit Line for Businesses $142.30).

Mid‑ to top‑funnel educators

Use these to build authority and retargeting pools.

- “what is EMI” and “loan types” — content assets, calculators, and listicles to grow search volume.

- “average cost per click in finance” — research content that feeds paid strategy and lowers blended CAC.

Modifier power plays

Location and urgency narrow intent and raise competition. Bid only when operations can fulfil demand.

- “near me,” “fast,” “best,” “California” — target by geo, device, and hour.

- Budget split: allocate 70–80% to bottom-funnel keywords, reserve 20–30% to demand-gen and remarketing.

“Route each keyword cluster to one intent-matched landing with bespoke proof and qualification-first flows.”

How to win with high CPC finance keywords without overspending

Winning pricey search auctions starts with ruthless relevance and measurable controls.

We raise Quality Score by building tightly themed ad groups and ad text that mirrors user intent. That boosts expected CTR and improves landing experience. The result is lower cost per click and better conversion paths.

Practical controls that cut waste

We deploy negative terms weekly to stop ambiguous matches around EMI, student, and noncommercial search queries.

Landing page and offer playbook

One page per intent cluster with mirrored copy and a clear offer. WordStream data shows optimized pages can push conversion into the 20–30% range versus ~2% averages.

Bid strategy and segmentation

- Implement SKAGs/SEG to isolate intent and lift Quality Score.

- Tier bids by device, hour, and geo to feed budget to proven micro-pockets of demand.

- A/B test offers (pre‑approval, instant rate, fee waivers) and double down on winners.

“We instrument conversion tracking, offline events, and revenue mapping so marketing spend follows actual profit.”

| Action | Immediate Impact | Metric to Track |

|---|---|---|

| SKAGs / SEG setup | Higher ad relevance, lower cost per click | Quality Score, CTR |

| Negative keyword mining | Reduced wasted spend | Search-to-conversion ratio |

| Intent-matched page | Conversion uplift to 20–30% | Conversion rate, revenue per visitor |

| Dayparting & geo bids | Budget moves to profitable pockets | CPA by device/hour/geo |

We combine ppc advertising and seo tactics—calcs, comparisons, and FAQs—to lower paid dependency over time. Our management playbook codifies these steps so the company scales repeatably with measurable ROI.

Cross-industry proof points: where expensive keywords show similar dynamics

We observe that urgency and precise intent trigger premium bids in many industries, not just lending.

Home services offer a clear example. Terms tied to water damage and flood repair command large bids because the need is immediate and the ticket is sizable.

House and property emergencies

Search volume shows Water Damage Restoration Dallas at $250.79 and Water Damage Repair Houston at $114.43.

Flood Repair Chicago runs near $151.79. These figures confirm that emergency damage repair search queries carry an urgency tax.

Real estate urgency beats generic estate search

Specific terms like “Get Offer on House” ($189.78) and “Sell House Fast for Cash” (~$130) outperform broad real estate queries.

When people search with a selling intent, value is monetizable immediately.

Insurance, education, and other verticals

Car insurance quotes and life insurance searches rise with policy lifetime value. Education can top $298.86 for “Online College Business Degree.”

Even B2B software shows similar math: recurring revenue justifies aggressive bids.

“Urgency, lifetime value, and specificity form the trifecta that concentrates search volume and inflates bids across sectors.”

Practical takeaways:

- Target emergency and outcome-driven search terms with intent-matched landing pages.

- Use SKAG/SEG, negative mining, and rapid creative tests to own the profitable spikes.

- Don’t trust averages; model the spike pockets where the true margin lives.

| Vertical | Representative term | Top-of-page bid (USD) | Why it pays |

|---|---|---|---|

| Home services | Water Damage Restoration Dallas | $250.79 | Immediate repair need; high ticket |

| Real estate | Get Offer on House | $189.78 | Direct monetizable intent |

| Education | Online College Business Degree | $298.86 | High lifetime enrollment value |

| Insurance | Car insurance quotes (metro) | $75–$98+ | Policy LTV and bundling potential |

PPC + SEO synergy: a scalable plan for finance and small business growth

A synchronized paid-and-organic model turns expensive clicks into compounding organic advantage. We build a single operating model so paid data drives content, and content lowers blended acquisition cost.

Organic moat: build pages for high-intent terms

We target conversion-first pages for top search intent. These pages reduce paid reliance as rankings mature.

Action: prioritize landing pages, calculators, and multi-part guides that mirror ad funnels and capture qualified leads.

Search term mining: turn paid reports into SEO clusters

We mine paid search reports and search volume shifts weekly. That mining seeds authoritative content, FAQs, and a learning course that converts EMI learners into applicants.

We sync ppc advertising and seo briefs so ad copy, schema, and on-page elements reinforce one message.

“Use paid query data to build an organic moat—measure revenue across channels and iterate weekly.”

| Step | Immediate Win | Metric |

|---|---|---|

| Mine paid search terms | Priority content list | Search volume, conversions |

| Publish conversion pages | Lower per click spend | Blended CAC, revenue |

| Centralize measurement | Allocate budget to winners | Revenue by channel |

Outcome: strategic alignment converts volatility into momentum and protects margin. Our experts run the sprint cadence the company needs to scale.

Finance Keywords High CPC: actionable targets, budgets, and page types

Owners and CMOs need clear allocation rules that tie every bid to a measurable close rate. We set concrete targets, guardrails, and page templates so paid spend converts into predictable revenue.

Transactional targets and budget logic

- Priority anchors: business loan, invoice factoring, credit line for businesses. Allocate 60–80% of acquisition budget here when close rates exceed forecast.

- Bid guidance: use Google Ads Planner ranges (Credit Line for Businesses ~$142.30; Invoice Factoring CA ~$119.22; Business Loan ~$71.34) to set test caps and average cost guardrails.

- Measurement: require one revenue event per cohort before scaling spend.

Supportive commercial research

Best bank for small business and business financial management pages feed the funnel. These assets lower per click waste and shorten the path to application.

Location and speed modifiers

- Layer “near me,” city/state, “fast,” “same day” only where operations can deliver SLA.

- Test modifiers with capped bids; push the highest cpc only after repeatable conversion proofs.

Recommended page mix

- Service pages for each loan product with clear rates, timeline, and testimonials above the fold.

- Comparison and calculator pages to capture buyers researching options.

- Course-style guides to nurture small business owners and build remarketing pools.

“Target transaction anchors first; support with research content and strict revenue gating before scaling bids.”

| Asset | Primary KPI | When to Scale |

|---|---|---|

| Service page | Application rate | CPA within average cost guardrail |

| Calculator | Qualified leads | Lift in close rate by cohort |

| Course guide | Retention & remarket list | Enough volume for lookalike tests |

Action: segment retargeting by search term clicked and asset consumed, then sequence with ecommerce-style UX and digital marketing remarkets to convert the next-best action.

Conclusion

, Winning premium search slots requires systems, not bigger budgets. We convert volatile search volume into repeatable returns by mapping intent, measuring revenue, and tightening landing experience.

Our model is simple: verify Planner data, segment by intent, and sync marketing and seo playbooks to lower cost per click and raise conversion. For small business and company teams, this approach turns expensive keywords into reliable growth.

Whether you run software, online college, life insurance, car insurance, home or real estate offers, the unit economics are the same. Book Macro Webber’s Growth Blueprint now—claim a prioritized action plan in 7 days and lock the search share before competitors raise the average cost.

We lead; you compound. Schedule a consultation to operationalize WebberXSuite™ and the A.C.E.S. Framework and turn per click chaos into measurable scale.