The wealth management landscape stands at a critical inflection point. With $62 trillion in assets under management expected to grow to $85 trillion by 2028, the opportunity is immense—but only for those who successfully navigate digital transformation. Today’s investors demand more than traditional portfolio management; they expect personalized experiences, seamless digital interactions, and comprehensive financial guidance delivered on their terms.

For wealth managers, investment advisors, and private equity firms, the mandate is clear: evolve digitally or risk obsolescence. This isn’t merely about implementing new technologies—it’s about fundamentally reimagining how you deliver value in an increasingly competitive marketplace where client expectations are being shaped by experiences far beyond financial services.

The Urgent Case for Digital Transformation

The wealth management industry faces unprecedented pressure from multiple directions. The great wealth transfer—with $84 trillion changing hands over the next two decades—means a new generation of digitally-native clients with fundamentally different expectations. Meanwhile, fintech disruptors continue gaining ground, with digital-direct firms achieving double-digit growth in relationships valued above $10 million.

Regulatory complexity adds another layer of challenge. Cross-border wealth management now navigates international tax transparency initiatives like FATCA and the OECD’s Common Reporting Standard, requiring sophisticated compliance technology. Simultaneously, economic pressures intensify as cost-to-income ratios reach 78% for smaller asset managers while return on assets continues declining.

The data tells a compelling story: RIAs using integrated technology serve 57% more clients and generate 46% more revenue. For independent broker-dealers with comprehensive integration, the benefits multiply: 44% more clients served, doubled assets, and revenue increases of 73%. The message is clear—digital transformation isn’t optional; it’s existential.

Unique Challenges Facing Wealth Management and Private Equity

Industry Strengths

- Established trust relationships with high-net-worth clients

- Deep expertise in complex financial products and strategies

- Significant assets under management providing resources for transformation

- Ability to deliver high-touch, personalized service

Digital Transformation Challenges

- Legacy systems with fragmented data across multiple silos

- Regulatory compliance requirements limiting innovation speed

- Advisor resistance to technology adoption

- Cybersecurity concerns with sensitive financial data

- Balancing automation with human expertise

The Data Quality Dilemma

At the heart of digital transformation lies a fundamental challenge: data quality. Many traditional firms operate with outdated data of questionable quality resting in silos. Even when technically accessible, low confidence in data quality leads to poor insights. Without a holistic data strategy and governance framework, firms struggle to realize value from their digital investments.

The Personalization Paradox

Today’s clients expect hyper-personalization—where their unique characteristics and real-time data drive targeted services. Yet delivering this at scale requires sophisticated technology that many firms lack. The mass affluent segment (individuals with $100,000-$1 million in liquid assets) represents a particularly challenging opportunity, requiring scalable tech-driven strategies that seamlessly integrate digital efficiency with personalized service.

The Advisor Efficiency Gap

Most advisors spend 70% of their time on manual back-office tasks, dealing with slow customer onboarding, account migrations, compliance checks, and paperwork across disparate systems. This administrative burden directly reduces client face time and firm profitability. Without standardized processes and modern tools, new team members learn through trial and error, creating service inconsistencies.

Identify Your Digital Transformation Barriers

Not sure where your organization stands? Our complimentary Digital Readiness Assessment identifies your specific barriers to transformation and provides actionable recommendations.

7 Proven Digital Growth Strategies for Wealth Management

Forward-thinking wealth management firms are implementing these seven strategies to drive growth, enhance client experiences, and improve operational efficiency. Each strategy addresses specific pain points while creating measurable business value.

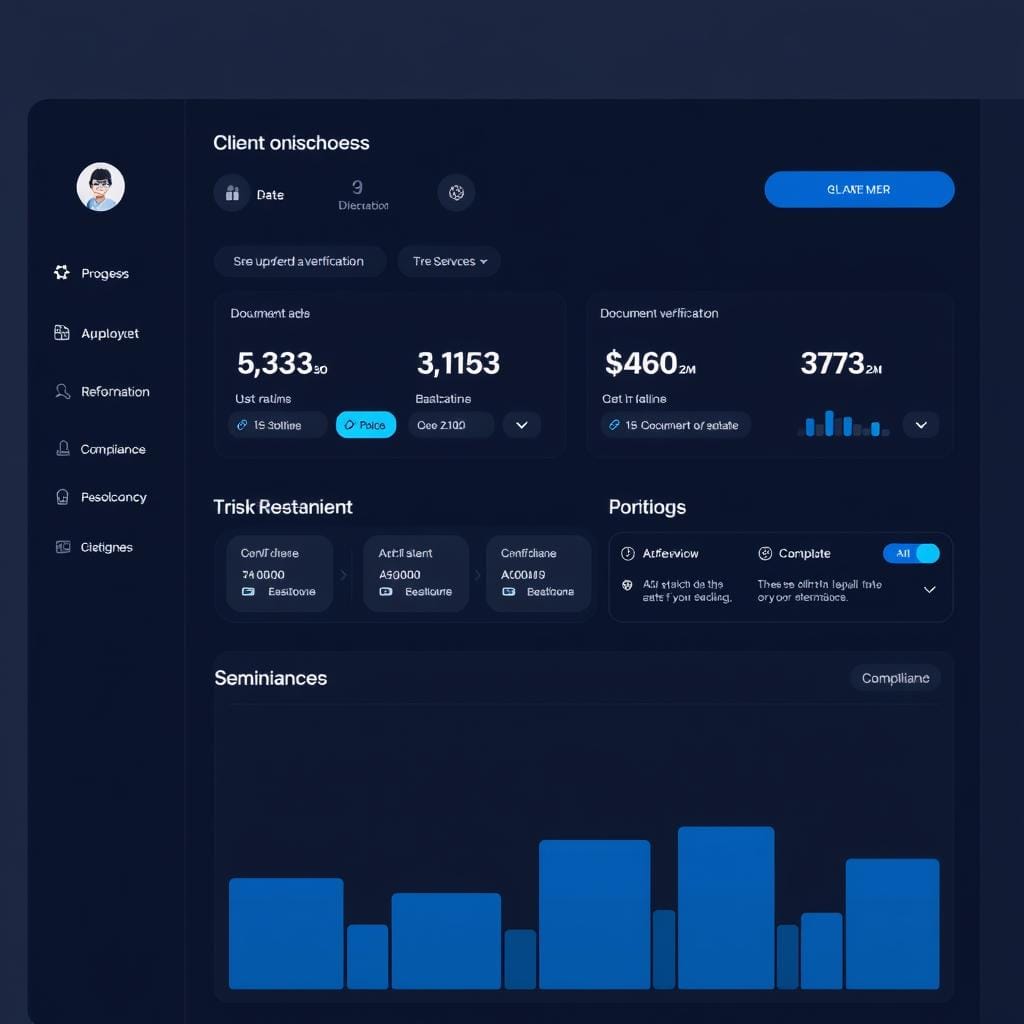

1. AI-Powered Client Onboarding and Portfolio Analysis

Traditional onboarding processes are time-consuming and paper-intensive, creating friction at the critical first stage of the client relationship. AI-driven onboarding reduces this process from weeks to days by automating document verification, risk profiling, and compliance checks.

For portfolio analysis, AI systems can analyze vast datasets to identify optimization opportunities across asset classes. These systems continuously monitor portfolios against client goals, automatically flagging rebalancing needs and potential investment opportunities aligned with client preferences.

“AI-enabled advisors at our firm have increased client capacity by 40% while reducing onboarding time from 23 days to just 4, dramatically improving both efficiency and client satisfaction.”

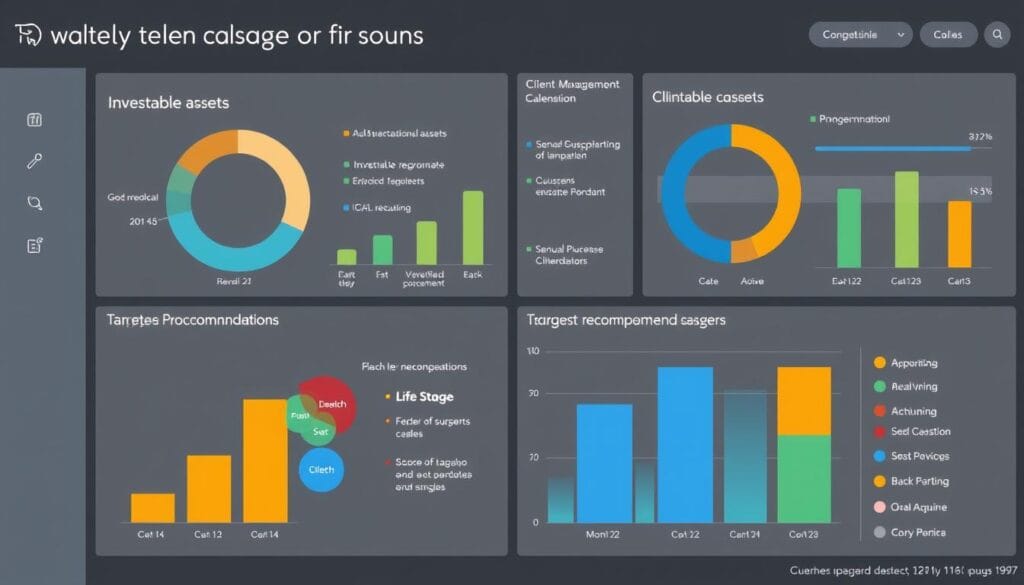

2. Personalized Client Portals with Real-Time Insights

Modern client portals transform how investors interact with their wealth. Unlike basic reporting tools, these platforms provide comprehensive visibility across all assets—including alternatives like private equity, real estate, and collectibles—with real-time performance tracking and goal monitoring.

The most effective portals incorporate personalized insights driven by AI, highlighting opportunities relevant to the client’s specific situation and preferences. They also facilitate secure document exchange, digital signatures, and seamless communication with advisors through preferred channels.

Implementation requires integration with core systems, careful UX design focused on simplicity, and robust security protocols. Firms that excel in this area report 11-point higher client satisfaction scores and significantly improved retention rates.

3. Blockchain for Transparent Private Equity Transactions

Private equity has traditionally suffered from opacity and administrative inefficiency. Blockchain technology addresses these challenges by creating immutable transaction records, automating compliance verification, and enabling fractional ownership of previously inaccessible assets.

Leading firms are implementing blockchain solutions for:

- Streamlining capital calls and distributions through smart contracts

- Creating transparent audit trails for regulatory compliance

- Enabling secondary market liquidity for traditionally illiquid investments

- Reducing settlement times from days to minutes

- Automating carried interest calculations and distributions

While implementation complexity remains high, early adopters report 30-45% reductions in administrative costs and significantly improved investor satisfaction with reporting transparency.

4. Data-Driven Prospecting and Client Segmentation

Advanced analytics transforms client acquisition and relationship management by identifying high-potential prospects and revealing deeper insights about existing clients. Forward-thinking firms leverage multiple data sources—including CRM data, market intelligence, and behavioral signals—to create sophisticated segmentation models that go beyond traditional wealth tiers.

These models enable highly targeted outreach based on specific life events, behavioral patterns, and investment preferences. For existing clients, predictive analytics can identify attrition risks, cross-sell opportunities, and optimal communication timing and channels.

Firms implementing these approaches report 77% increases in client retention and 25-40% improvements in marketing ROI compared to traditional methods.

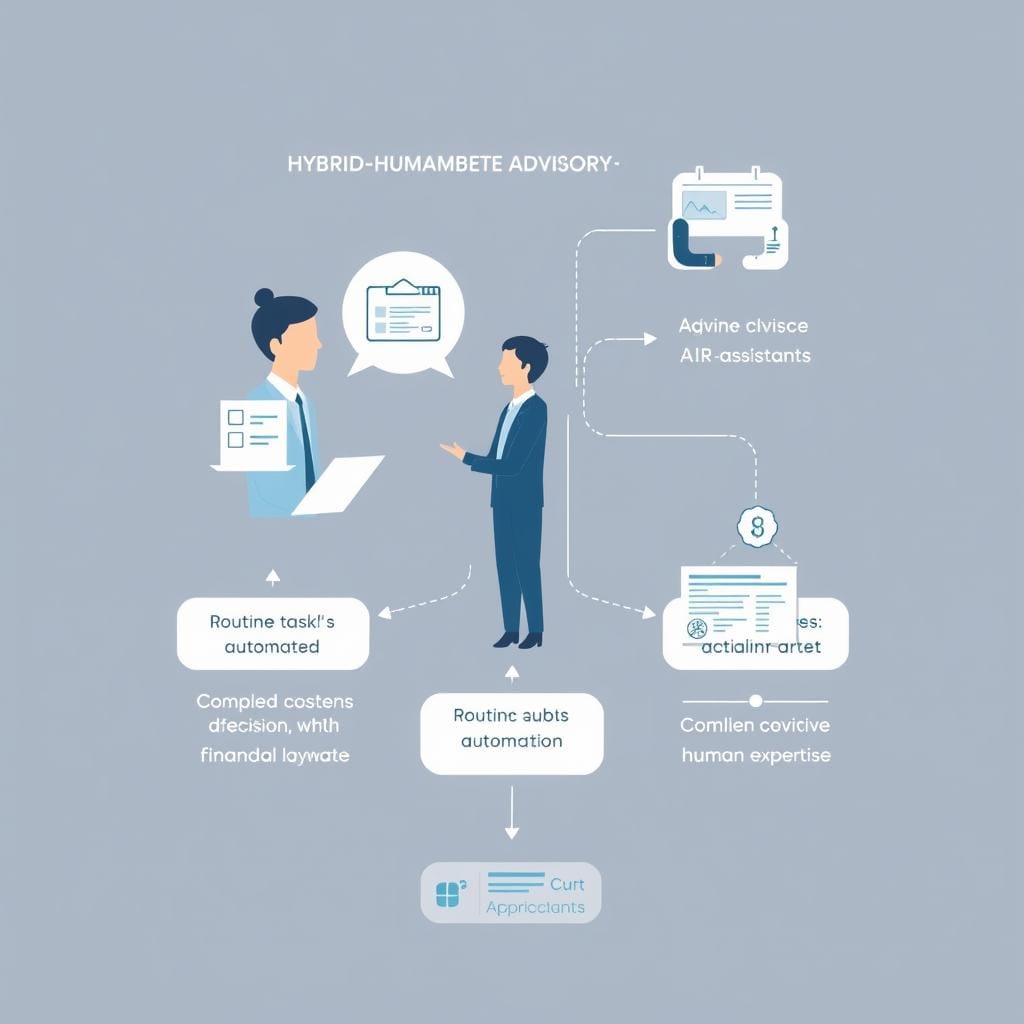

5. Hybrid Human-Digital Advisory Models

The future of wealth management isn’t purely digital or purely human—it’s a thoughtful integration of both. Hybrid models leverage technology for scale and efficiency while preserving the human judgment and relationship elements that high-net-worth clients value.

In effective hybrid models, digital platforms handle routine transactions, basic education, and initial planning, while human advisors focus on complex strategy, behavioral coaching, and relationship building. This approach allows firms to profitably serve the previously underserved mass affluent segment while enhancing the experience for high-net-worth clients.

Implementation requires careful service model design, advisor training, and technology that augments rather than replaces human capabilities. Firms that successfully implement hybrid models report serving 50-80% more clients per advisor while maintaining or improving satisfaction scores.

6. Alternative Asset Integration and Analytics

As investor demand for alternatives grows, wealth managers must develop capabilities to seamlessly incorporate these assets into holistic portfolios. This requires both technological infrastructure and specialized expertise.

Leading firms are implementing platforms that provide:

- Unified performance reporting across traditional and alternative investments

- Automated data extraction from private investment documents

- Risk analysis tools specifically designed for illiquid assets

- Scenario modeling for complex alternative structures

- Digital access to previously exclusive alternative opportunities

These capabilities are particularly valuable as private market assets under management continue growing at twice the rate of public market AUM, expected to reach $60 trillion by 2033.

7. Compliance Automation and Regulatory Technology

Regulatory complexity continues increasing across jurisdictions, creating both risk and operational burden. RegTech solutions transform compliance from a cost center to a competitive advantage by automating monitoring, reporting, and verification processes.

Advanced compliance platforms leverage AI to continuously monitor transactions against evolving regulations, automatically flag potential issues, and generate required documentation. These systems can reduce compliance costs by 30-40% while improving accuracy and reducing regulatory risk.

Implementation requires close collaboration between technology, compliance, and business teams, with careful attention to system validation and governance.

Implement These Strategies With Confidence

Our strategic implementation framework helps wealth management firms prioritize and execute digital initiatives for maximum ROI. Schedule a consultation to discuss your specific needs.

Digital Transformation Success Stories

These case studies demonstrate how forward-thinking wealth management firms have successfully implemented digital strategies to drive measurable business results.

Client Experience Transformation

Challenge: A growing RIA with $1.2B AUM struggled with inconsistent client experiences and inefficient onboarding processes that limited growth.

Solution: Implemented an integrated client portal with automated onboarding, personalized reporting, and secure document exchange.

Results:

- Reduced onboarding time from 3 weeks to 4 days

- Increased client satisfaction scores by 32%

- Grew AUM by 28% in 18 months

- Enabled advisors to manage 40% more relationships

Investor Relations Digitization

Challenge: A mid-market PE firm managing $3.5B struggled with manual investor reporting processes and limited transparency.

Solution: Deployed a blockchain-based investor portal with automated capital call management and real-time performance analytics.

Results:

- Reduced reporting cycle from 45 to 12 days

- Decreased administrative costs by 35%

- Improved fundraising efficiency by 28%

- Enhanced investor satisfaction scores by 41%

Mass Affluent Expansion

Challenge: A traditional wealth manager sought to profitably serve the mass affluent segment without diluting their high-touch service model.

Solution: Developed a hybrid advisory platform with AI-powered financial planning and targeted human intervention.

Results:

- Reduced minimum account size from $1M to $250K

- Acquired 1,200+ new clients in first year

- Maintained 80% gross margins on new segment

- Created $4.2M in new annual recurring revenue

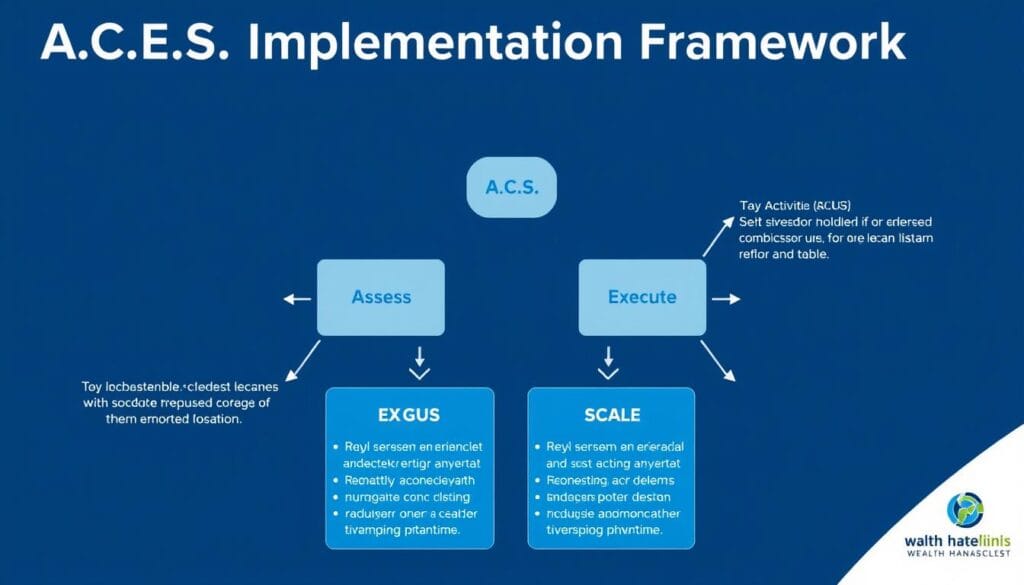

The A.C.E.S. Implementation Framework

Successful digital transformation requires more than technology—it demands a structured approach that addresses people, processes, and systems holistically. Our proprietary A.C.E.S. Framework provides a proven methodology for wealth management firms to implement digital growth initiatives with predictable outcomes and measurable ROI.

Assess

- Conduct digital maturity assessment

- Identify capability gaps

- Benchmark against industry leaders

- Prioritize opportunities by impact

Create

- Design target operating model

- Develop technology roadmap

- Build business case with ROI metrics

- Create change management plan

Execute

- Implement in agile sprints

- Integrate systems and data

- Train staff on new capabilities

- Measure progress against KPIs

Scale

- Expand successful pilots

- Optimize based on feedback

- Automate manual processes

- Continuously enhance capabilities

Implementation Insight: The most successful digital transformations start with quick wins that build momentum while laying the foundation for more complex initiatives. Begin with high-impact, low-complexity projects that demonstrate value and generate organizational buy-in.

Essential Technology Stack for Wealth Management Digital Growth

Building an effective digital ecosystem requires carefully selected technologies that work together seamlessly. These recommended platforms address the specific needs of wealth managers, investment advisors, and private equity firms.

| Category | Function | Key Capabilities | Implementation Considerations |

| Client Engagement | Client portals, mobile apps, communication tools | Personalized dashboards, document sharing, secure messaging, goal tracking | Prioritize intuitive UX, mobile-first design, and seamless advisor collaboration |

| Portfolio Management | Investment analysis, rebalancing, reporting | Multi-asset class support, tax optimization, custom models, performance attribution | Data quality is critical; ensure robust integration with custodians |

| Data Aggregation | Unified data collection across accounts and assets | 15,000+ financial data sources, held-away assets, alternatives tracking | Evaluate connection success rates and data cleansing capabilities |

| CRM & Analytics | Client relationship management, business intelligence | 360° client view, opportunity identification, activity tracking, segmentation | Integration with portfolio systems is essential for unified insights |

| Compliance & RegTech | Regulatory monitoring, documentation, risk management | Automated monitoring, audit trails, cross-border compliance, documentation | Ensure configurability for evolving regulations across jurisdictions |

| AI & Machine Learning | Personalization, automation, insights generation | Client segmentation, next-best-action recommendations, document processing | Start with focused use cases that deliver measurable ROI |

Integration Strategy: Rather than attempting to build a monolithic system, focus on creating a composable architecture with best-of-breed components connected through standardized APIs. This approach provides flexibility to adapt as technology evolves while maintaining data consistency across systems.

The Future of Wealth Management: Emerging Trends

The wealth management landscape continues evolving rapidly. These emerging trends will shape the industry over the next 3-5 years, creating both opportunities and challenges for established firms.

Metaverse Client Experiences

Virtual environments will enable immersive client interactions, allowing advisors and clients to visualize complex financial concepts, collaborate on planning scenarios, and engage in ways impossible through traditional channels. Early experiments show particularly strong engagement from younger investors.

Embedded Wealth Services

Wealth management capabilities will increasingly be embedded into non-financial platforms, from luxury goods marketplaces to professional networks. This distribution model will create new client acquisition channels while challenging traditional firm boundaries.

Predictive Financial Planning

Advanced AI will enable truly predictive planning that anticipates client needs before they arise. These systems will proactively identify opportunities, suggest portfolio adjustments, and provide behavioral nudges to keep clients on track toward their goals.

Decentralized Finance Integration

DeFi protocols will increasingly be incorporated into traditional wealth management, enabling programmable money flows, automated trust structures, and novel yield generation strategies. Forward-thinking firms are already building capabilities to bridge these worlds.

Quantum Computing Applications

As quantum computing matures, it will revolutionize portfolio optimization, risk modeling, and market prediction. Firms that prepare now by developing quantum-ready algorithms will gain significant advantages in investment performance and risk management.

Hyper-Personalized Products

Mass customization will enable truly personalized investment products tailored to individual values, goals, and constraints. Direct indexing at scale will become the norm, with automated customization based on client-specific parameters.

Strategic Imperative: While these trends may seem futuristic, the foundations for each are being laid today. Firms that wait for full maturity before developing capabilities will find themselves years behind more forward-thinking competitors. The time to begin exploring and experimenting with these technologies is now.

Position Your Firm for Digital Growth Success

The wealth management industry stands at a digital crossroads. The evolution from manual, fragmented systems to elegant, intelligent platforms addresses fundamental limitations while delivering measurable business value. Firms that successfully navigate this transformation will capture disproportionate growth in an increasingly competitive market.

The business case is clear: advisors using integrated technology serve 50% more clients while delivering twice as many financial plans. Client satisfaction scores tell a similar story—digital engagement creates happier, more loyal clients. Financial results prove equally impressive, with digitally-enabled RIAs generating 46% more revenue while reducing operational costs by 30-45% through intelligent automation.

Implementation challenges exist—data security, user adoption, and legacy system migration require careful planning. However, with the right strategic approach and implementation partner, these obstacles can be overcome, positioning your firm for sustainable growth and competitive advantage.

The future belongs to wealth managers who embrace digital excellence. Those who cling to outdated systems risk falling behind as clients increasingly expect sophisticated digital capabilities alongside expert human guidance.

Take the First Step: Assess Your Digital Maturity

Our complimentary Digital Maturity Audit helps wealth management firms identify their current capabilities, benchmark against industry leaders, and develop a prioritized roadmap for transformation. Schedule yours today to begin your journey toward digital growth excellence.

Frequently Asked Questions

How long does a typical digital transformation take for a wealth management firm?

Digital transformation timelines vary based on organizational size, complexity, and ambition. A comprehensive transformation typically spans 18-36 months, though significant value can be realized within 3-6 months through properly sequenced initiatives. We recommend a phased approach that delivers quick wins while building toward longer-term capabilities.

What ROI can we expect from digital transformation investments?

Well-executed digital initiatives typically deliver 3-5x ROI over a three-year period. Specific returns vary by focus area: client experience improvements generally yield 15-25% growth in AUM, advisor efficiency initiatives reduce costs by 20-30%, and advanced analytics drive 10-15% revenue increases through improved targeting and cross-selling.

How do we balance digital innovation with regulatory compliance?

Successful firms incorporate compliance considerations from the beginning rather than treating them as an afterthought. This means involving compliance teams in the design phase, implementing “compliance by design” principles in technology architecture, and leveraging RegTech solutions that automate compliance processes. With the right approach, compliance can become an enabler rather than a barrier to innovation.

What’s the best approach for legacy system migration?

We recommend a pragmatic approach based on business priorities rather than technical considerations alone. This typically involves a combination of strategies: 1) Core systems replacement for critical capabilities, 2) API-based integration for systems with remaining useful life, and 3) Data extraction and retirement for obsolete systems. The key is developing a clear data strategy that ensures consistency across the transition.