The luxury e-commerce landscape presents a unique paradox: how to achieve substantial growth while maintaining the exclusivity and exceptional experience that defines luxury. For founders and executives of direct-to-consumer luxury brands generating $5M+ in annual revenue, scaling presents both unprecedented opportunities and complex challenges. The digital transformation of luxury has accelerated dramatically, with Bain & Company forecasting that 30% of all luxury sales will take place online by 2025. Yet scaling a luxury DTC brand requires a fundamentally different approach than mass-market e-commerce growth. This article explores the strategic frameworks, technological innovations, and operational excellence required to scale your luxury e-commerce brand without diluting its essence.

The Unique Challenges of Scaling Luxury E-commerce

Luxury DTC brands face distinct obstacles when scaling that their mass-market counterparts rarely encounter. Understanding these challenges is the first step toward developing effective scaling strategies.

The fundamental challenges luxury DTC brands face when scaling operations

The Exclusivity Paradox

The very essence of luxury is rooted in exclusivity and scarcity. As you scale, maintaining this perception becomes increasingly difficult. When Louis Vuitton faced this challenge, they responded by limiting online distribution of certain collections and creating digital “waiting rooms” for high-demand products. The data shows luxury brands that increase availability without strategic scarcity management experience a 15-20% decrease in perceived brand value among high-net-worth consumers.

Elevated Customer Expectations

Luxury customers expect white-glove service at every touchpoint. According to Luxury Institute research, 67% of luxury consumers cite personalized service as a primary reason for their brand loyalty. As your customer base expands, maintaining this level of personalized attention becomes exponentially more complex and resource-intensive. The challenge intensifies when operating across multiple markets with varying cultural expectations of luxury service.

Supply Chain Complexity

Luxury products often involve specialized materials, artisanal craftsmanship, and rigorous quality control. Scaling production while maintaining these standards presents significant operational challenges. For example, when Hermès attempted to scale production of their iconic Birkin bags, they faced a 24-month production backlog due to the limited availability of master craftspeople. This illustrates how traditional scaling approaches can compromise the very qualities that define luxury products.

Digital Experience Translation

Creating a digital experience that captures the sensory richness of in-store luxury shopping remains one of the industry’s greatest challenges. According to McKinsey, luxury consumers interact with brands across an average of nine touchpoints before making a purchase decision. Each of these touchpoints must convey the brand’s luxury positioning consistently while adapting to the constraints and opportunities of digital channels.

| Scaling Challenge | Luxury DTC Brands | Mass-Market DTC Brands |

| Growth Strategy | Controlled expansion with strategic scarcity | Rapid market penetration and volume growth |

| Customer Acquisition Cost (CAC) | $250-$1,200 | $15-$75 |

| Customer Lifetime Value (CLV) | $2,500-$15,000+ | $100-$500 |

| CLV:CAC Ratio Target | 10:1 or higher | 3:1 or higher |

| Service Expectation | Personalized, white-glove service | Efficient, responsive service |

| Digital Experience | Immersive, sensory-rich, exclusive | Convenient, frictionless, accessible |

7 Strategic Frameworks for Scaling Luxury E-commerce

Successfully scaling a luxury DTC brand requires a strategic approach that balances growth with brand integrity. The following frameworks provide a roadmap for sustainable scaling while enhancing your luxury positioning.

The 7 strategic frameworks for scaling luxury e-commerce while maintaining brand integrity

1. The Hybrid Retail Ecosystem

Rather than viewing physical and digital channels as separate entities, leading luxury brands are creating integrated ecosystems where each channel reinforces the other. Burberry pioneered this approach with their “social retail” concept, which seamlessly blends digital engagement with physical store experiences. Their WeChat mini-program allows customers to book in-store appointments, unlock exclusive content, and earn social currency that enhances their in-store experience.

For scaling luxury DTC brands, this means strategically expanding physical touchpoints (flagship stores, pop-ups, shop-in-shops) while ensuring these spaces serve as extensions of your digital experience rather than separate channels. The data supports this approach: luxury brands with integrated omnichannel strategies report 30% higher customer lifetime value compared to digital-only or primarily physical models.

2. AI-Driven Hyper-Personalization

Artificial intelligence offers luxury brands the ability to scale personalization without proportionally scaling human resources. Net-A-Porter’s EIP (Extremely Important Person) program uses AI to analyze customer data and preferences, enabling their personal shoppers to provide highly tailored recommendations at scale. Their system tracks over 600 data points per customer to create personalized product curation.

Implementing AI-driven personalization requires significant investment in both technology and data infrastructure, but the returns are substantial. Luxury brands utilizing advanced personalization report a 40% increase in average order value and 50% higher repeat purchase rates compared to those using basic personalization techniques.

Elevate Your Luxury Brand’s Personalization Strategy

Discover how our AI-powered personalization framework has helped luxury DTC brands achieve 35% higher customer retention while scaling operations. Download our exclusive guide to implementing hyper-personalization at scale.

3. Exclusive Digital Experiences

Digital exclusivity is emerging as a powerful tool for luxury brands seeking to scale while maintaining their aspirational positioning. Chanel’s approach of limiting e-commerce to beauty and fragrance products while requiring in-store visits for fashion and accessories creates digital scarcity that preserves brand mystique. Similarly, Dior’s virtual fashion shows provide access to exclusive content while controlling the digital experience.

For scaling DTC luxury brands, creating tiered access to digital experiences based on customer value can replicate the exclusivity of physical luxury retail. This might include invitation-only virtual events, early access to new collections for VIP clients, or exclusive digital content that enhances the product experience.

4. Strategic Brand Partnerships

Collaborations with complementary luxury brands or cultural institutions can accelerate growth while reinforcing brand positioning. Louis Vuitton’s collaboration with Supreme demonstrated how a heritage luxury brand could access new customer segments without diluting its luxury credentials. The limited-edition collection sold out within minutes and generated unprecedented demand.

When evaluating potential partnerships, luxury DTC brands should prioritize cultural alignment over immediate commercial potential. The most successful luxury collaborations create authentic connections that enhance brand storytelling rather than merely expanding distribution.

5. Sustainable Luxury as Differentiation

Sustainability has evolved from a nice-to-have to a critical differentiator in the luxury sector. Stella McCartney built her entire luxury brand on sustainable principles, proving that ethical production and luxury positioning can coexist. As you scale, embedding sustainability throughout your supply chain not only addresses growing consumer expectations but creates a compelling narrative that justifies premium pricing.

According to Boston Consulting Group, 60% of luxury consumers consider a brand’s sustainability practices when making purchase decisions, with this percentage rising to 75% among millennial and Gen Z luxury consumers. Investing in sustainable packaging, transparent supply chains, and circular business models creates both ethical and commercial advantages as you scale.

Sustainable luxury packaging examples that maintain premium aesthetics while reducing environmental impact

6. Data-Driven Curation

As your product assortment expands, maintaining a cohesive brand story becomes increasingly challenging. Leading luxury e-commerce platforms like SSENSE and MatchesFashion use advanced analytics to curate their vast inventories into personalized customer experiences. Their approach combines algorithmic recommendations with human curation to create discovery experiences that feel both relevant and serendipitous.

For scaling luxury DTC brands, this means investing in both data infrastructure and merchandising expertise. The most effective curation strategies blend quantitative insights (purchase history, browsing behavior) with qualitative understanding of brand aesthetics and customer lifestyle.

7. Global Localization

International expansion is a natural scaling path for luxury brands, but success requires more than simply shipping to new markets. The concept of “global localization” involves maintaining consistent brand positioning while adapting the customer experience to local cultural contexts. Tmall’s Luxury Pavilion demonstrates this approach by creating China-specific digital experiences for global luxury brands that respect both the brand’s heritage and Chinese consumer preferences.

Effective global localization requires deep market research, local partnerships, and flexible technology infrastructure. Luxury brands that excel at this approach report 45% higher conversion rates in international markets compared to those using standardized global experiences.

| Scaling Strategy | Implementation Complexity | Resource Requirements | Expected ROI Timeframe | Impact on Brand Equity |

| Hybrid Retail Ecosystem | High | Significant capital investment | 18-24 months | Strong positive |

| AI-Driven Personalization | Medium-High | Technology investment, data expertise | 12-18 months | Moderate positive |

| Exclusive Digital Experiences | Medium | Creative resources, technology | 6-12 months | Strong positive |

| Strategic Partnerships | Medium | Relationship development, legal | 3-9 months | Variable (partner-dependent) |

| Sustainable Luxury | High | Supply chain investment, certification | 24-36 months | Strong positive |

| Data-Driven Curation | Medium | Analytics expertise, merchandising | 9-15 months | Moderate positive |

| Global Localization | High | Market research, local partnerships | 12-24 months | Moderate positive |

Case Studies: Luxury E-commerce Scaling Success Stories

Examining how leading luxury brands have successfully scaled their e-commerce operations provides valuable insights for your own growth strategy. The following case studies highlight different approaches to the scaling challenges we’ve discussed.

Case Study 1: SSENSE – Scaling Through Cultural Relevance

SSENSE’s approach to blending editorial content with commerce creates cultural relevance

Montreal-based luxury retailer SSENSE has grown from a boutique operation to a global e-commerce powerhouse with over 10 million monthly visitors. Their scaling strategy centers on cultural relevance rather than mere transactional efficiency. By investing heavily in editorial content that contextualizes their product offerings within broader cultural conversations, SSENSE has created a distinctive position in the crowded luxury e-commerce landscape.

Key to their success has been their technology infrastructure, which seamlessly integrates content and commerce. Their proprietary platform allows for rapid experimentation with new content formats and shopping experiences without compromising site performance. This technical foundation has enabled SSENSE to scale their operations while maintaining the creative flexibility that distinguishes their brand experience.

Results of their approach include:

- 70% year-over-year growth during their expansion phase

- Average order values 35% higher than luxury e-commerce industry averages

- Customer acquisition costs 25% lower than competitors due to organic discovery through content

- Repeat purchase rates of 60%, significantly above industry standards

The SSENSE case demonstrates how investing in distinctive content and technology infrastructure can create sustainable competitive advantages when scaling luxury e-commerce.

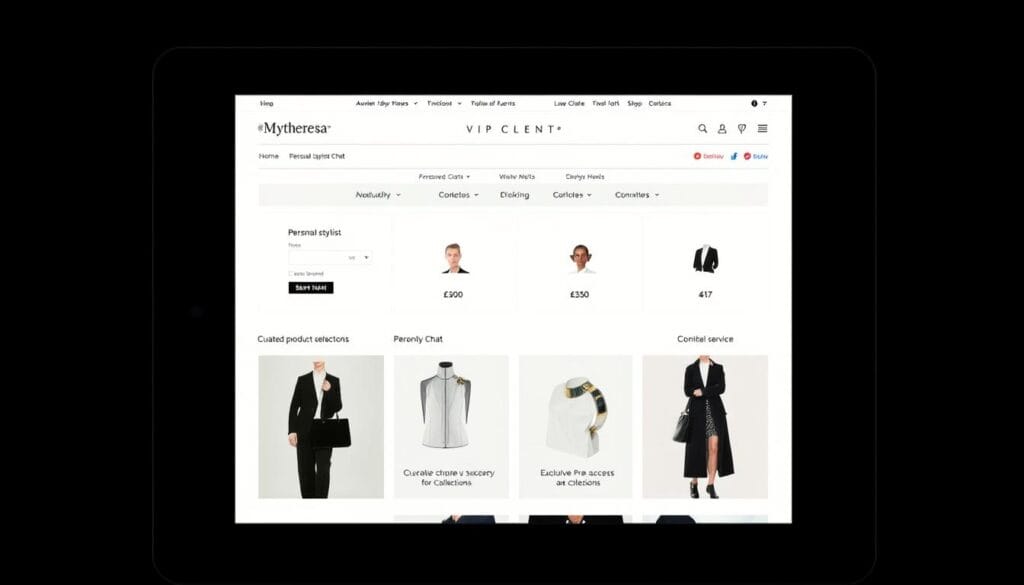

Case Study 2: Mytheresa – VIP Client Experience at Scale

Mytheresa’s digital VIP experience combines technology with human expertise

German luxury retailer Mytheresa has successfully scaled by focusing intensively on high-value customer relationships. Their approach centers on providing exceptional service to their top clients, who represent approximately 3% of their customer base but generate over 30% of revenue. Rather than pursuing aggressive customer acquisition, Mytheresa has prioritized deepening relationships with their most valuable clients.

Their scaling strategy includes:

- A dedicated personal shopping team that provides white-glove service to VIP clients

- Exclusive physical events in key markets that strengthen client relationships

- Early access to new collections and limited-edition products for top customers

- Technology that enables personal shoppers to provide consistent service across channels

This approach has yielded impressive results, including a 20% increase in average order value among VIP clients and customer retention rates above 90% for their top tier. By focusing on relationship depth rather than customer breadth, Mytheresa has achieved sustainable growth while maintaining their luxury positioning.

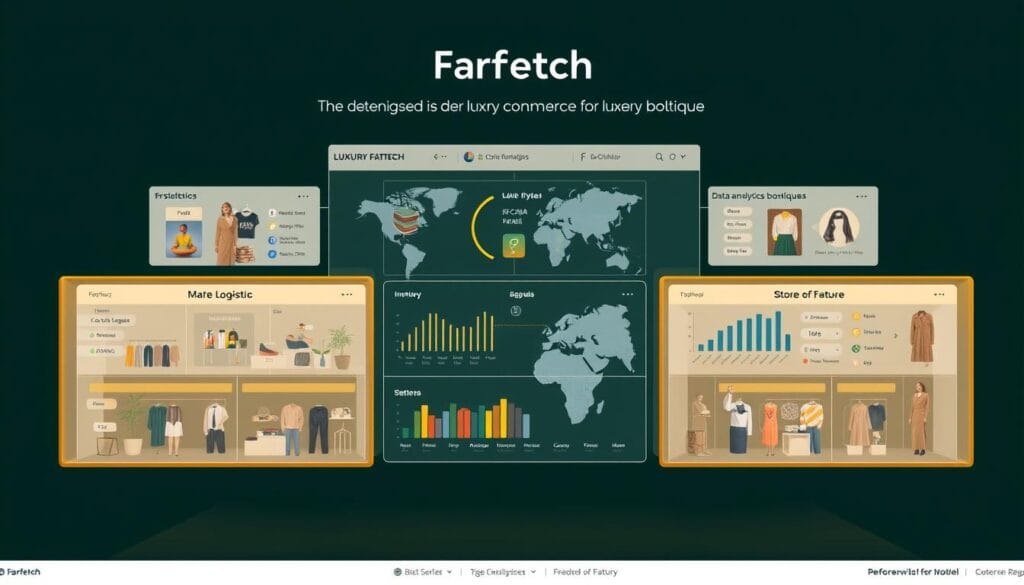

Case Study 3: Farfetch – Platform Scaling Through Technology

Farfetch’s platform technology connects boutiques globally while providing unified customer experience

Farfetch has pioneered a different approach to scaling luxury e-commerce through their marketplace model. By connecting over 700 boutiques and brands to global consumers, they’ve created a platform that scales through partnership rather than inventory ownership. Their technology-first approach has enabled rapid expansion while preserving the curation and expertise of independent luxury retailers.

Central to Farfetch’s scaling strategy is their suite of technology solutions, including:

- Farfetch Platform Solutions (FPS), which provides enterprise e-commerce infrastructure to luxury brands

- Farfetch Store of the Future, an operating system for physical retail that connects online and offline experiences

- Black & White, a white-label e-commerce solution for luxury brands

- Proprietary logistics network optimized for luxury products

By positioning themselves as both a marketplace and a technology provider, Farfetch has created multiple growth vectors. Their platform approach has enabled them to scale to over 190 countries while maintaining the distinctive selection and service that luxury consumers expect.

Implement Proven Scaling Frameworks for Your Luxury Brand

Our team has helped luxury DTC brands achieve an average of 40% year-over-year growth while enhancing brand equity. Book a complimentary strategy session to identify your optimal scaling path.

Implementation Roadmap: From Strategy to Execution

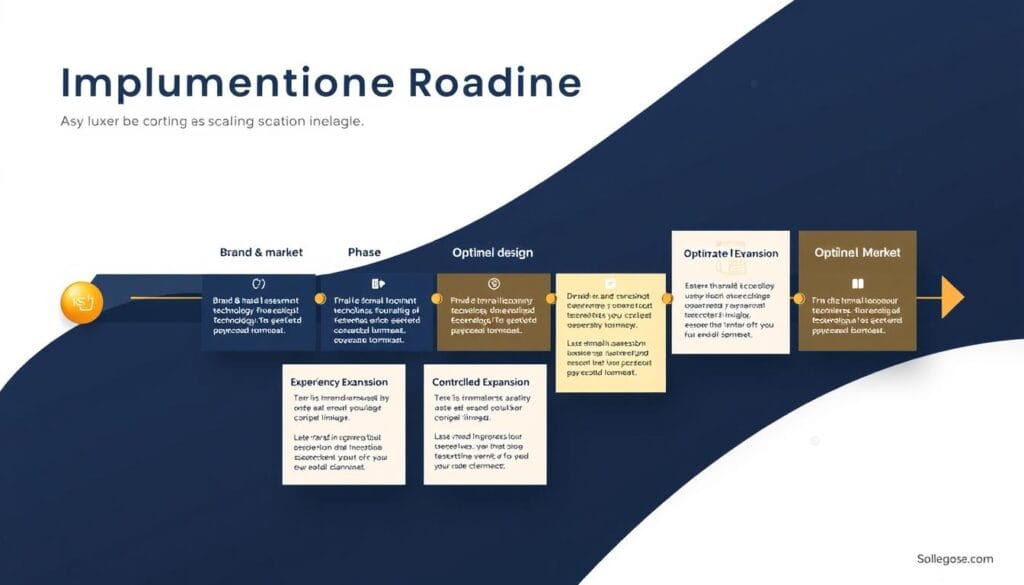

Translating strategic frameworks into operational reality requires a structured approach. The following roadmap provides a sequenced plan for implementing scaling initiatives while managing risk to your brand equity.

Five-phase implementation roadmap for scaling luxury e-commerce operations

Phase 1: Brand & Market Assessment (1-2 Months)

Before implementing any scaling initiatives, conduct a comprehensive assessment of your brand positioning and market opportunity. This phase should include:

- Customer segmentation analysis to identify your most valuable customer cohorts

- Competitive landscape mapping to identify whitespace opportunities

- Brand equity measurement to establish baseline metrics

- Technology infrastructure audit to identify scaling constraints

This assessment provides the foundation for all subsequent scaling decisions, ensuring that growth initiatives align with your brand’s core values and market position.

Phase 2: Technology Foundation (3-6 Months)

Building the right technology infrastructure is critical for scaling without compromising customer experience. Key investments during this phase include:

- Scalable e-commerce platform with luxury-specific capabilities

- Customer data platform (CDP) to unify customer information across channels

- Order management system optimized for complex fulfillment scenarios

- Analytics infrastructure to measure performance and inform decisions

The technology foundation should prioritize flexibility and integration capabilities, allowing you to adapt quickly as your scaling strategy evolves.

Phase 3: Experience Design (2-4 Months)

With your technology foundation in place, focus on designing customer experiences that can scale without losing the personal touch that defines luxury. This phase includes:

- Service blueprint development to map the end-to-end customer journey

- Content strategy formulation to support consistent storytelling at scale

- Personalization framework implementation to tailor experiences to customer segments

- Channel integration planning to create seamless omnichannel experiences

Experience design should balance efficiency with emotional resonance, creating moments of delight that reinforce your luxury positioning even as you scale operations.

Phase 4: Controlled Expansion (6-12 Months)

With your foundation established, begin controlled expansion across products, channels, and markets. This phase should include:

- Phased product category expansion based on customer demand and brand fit

- Selective channel partnerships that extend reach without diluting control

- Market entry sequencing based on opportunity size and operational complexity

- Capacity building in fulfillment, customer service, and creative production

The key to successful expansion is maintaining tight feedback loops between growth initiatives and brand impact metrics, allowing you to adjust course quickly if scaling begins to compromise brand integrity.

Phase 5: Optimization & Refinement (Ongoing)

As your scaling initiatives mature, shift focus to continuous optimization based on performance data and customer feedback. This phase includes:

- Conversion rate optimization across the customer journey

- Customer lifetime value enhancement through loyalty and retention programs

- Operational efficiency improvements in fulfillment and inventory management

- Brand impact measurement to ensure scaling supports long-term equity

The optimization phase never truly ends, as the luxury market continues to evolve and customer expectations shift. Establishing robust feedback mechanisms ensures your scaling strategy remains responsive to changing conditions.

Executive dashboard for monitoring key luxury e-commerce scaling metrics

Critical Success Factors

Across all implementation phases, several factors consistently differentiate successful luxury scaling initiatives:

Success Enablers

- Executive alignment on brand guardrails during scaling

- Cross-functional teams that blend luxury expertise with technical capabilities

- Balanced metrics that measure both growth and brand impact

- Controlled testing approach that limits brand exposure to unproven concepts

- Investment in proprietary technology that creates sustainable advantages

Common Pitfalls

- Prioritizing growth metrics over brand equity measures

- Underinvesting in customer service capabilities during expansion

- Excessive discounting to drive short-term growth

- Overextending into product categories that dilute brand positioning

- Adopting standardized technology solutions not optimized for luxury

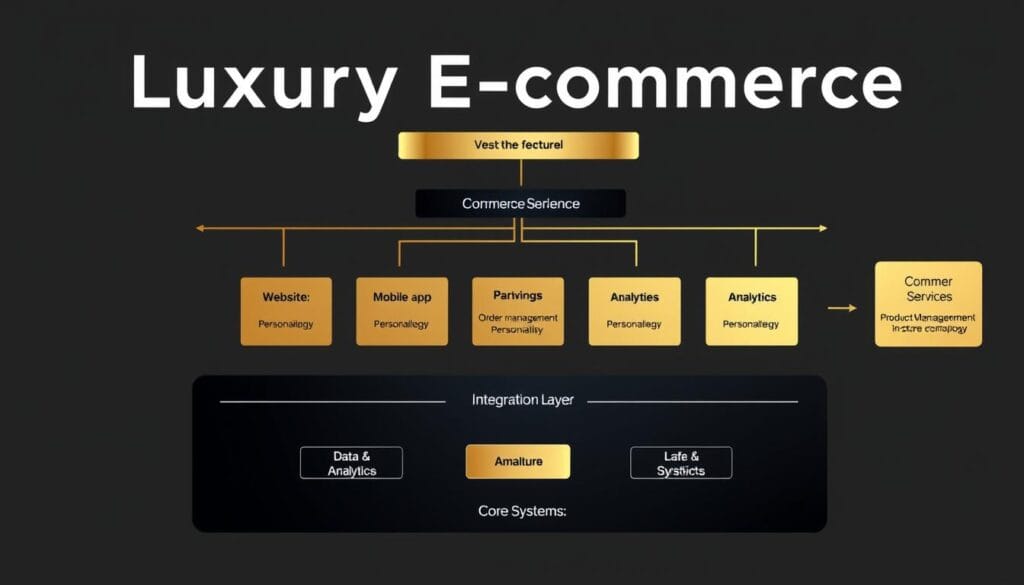

Technology Enablers for Luxury E-commerce Scaling

The right technology stack is essential for scaling luxury e-commerce operations without compromising the customer experience. The following technologies are particularly valuable for luxury brands seeking sustainable growth.

Integrated technology stack for scaling luxury e-commerce operations

Headless Commerce Architecture

Headless commerce separates the front-end presentation layer from back-end commerce functionality, enabling luxury brands to create distinctive customer experiences without sacrificing operational scalability. This architecture is particularly valuable for luxury brands that require both creative flexibility and enterprise-grade performance.

Leading luxury brands like Burberry have adopted headless architecture to support their omnichannel strategies. The approach allows them to rapidly deploy new customer experiences across channels while maintaining consistent business logic and inventory management. For scaling luxury DTC brands, headless commerce provides the technical foundation for both creative differentiation and operational excellence.

Artificial Intelligence & Machine Learning

Beyond personalization, AI and machine learning offer numerous capabilities that support luxury scaling, including:

- Demand forecasting that reduces inventory risk while ensuring availability

- Visual search that enhances product discovery without requiring precise terminology

- Customer service augmentation that maintains quality while increasing efficiency

- Content optimization that identifies the most effective creative assets

Luxury brands like Yoox Net-A-Porter Group are using AI to power their “Style Match” visual search capability, which allows customers to upload images and find similar products. This technology simultaneously improves the customer experience while reducing the operational burden of manual merchandising.

Augmented Reality & Virtual Try-On

AR technology helps bridge the sensory gap between physical and digital luxury retail. Brands like Gucci are using AR for virtual try-on of shoes and accessories, while beauty brands like Charlotte Tilbury offer virtual makeup testing. These technologies address a critical barrier to luxury e-commerce adoption: the inability to physically experience products before purchase.

For scaling luxury brands, AR investments can reduce return rates (a significant cost driver) while increasing conversion by building purchase confidence. The technology is particularly valuable for categories where fit, scale, or appearance on the customer is a key purchase consideration.

Distributed Order Management

As luxury brands scale across channels and markets, order management becomes increasingly complex. Distributed order management (DOM) systems optimize fulfillment decisions based on inventory location, delivery promises, and fulfillment costs. This capability is essential for luxury brands seeking to offer services like same-day delivery, ship-from-store, or reserve online/pickup in-store.

Luxury retailers like Neiman Marcus have implemented DOM systems to unify inventory across their store network and e-commerce operations, enabling them to promise accurate delivery dates while optimizing fulfillment costs. For scaling DTC brands, DOM provides the operational foundation for expansion into new channels and markets without compromising service quality.

Augmented reality virtual try-on experiences help bridge the sensory gap in luxury e-commerce

Customer Data Platforms

Customer data platforms (CDPs) unify customer information across channels and systems, creating a single view of each customer. This capability is particularly valuable for luxury brands, where personalized service is a core expectation. CDPs enable consistent recognition and service across touchpoints, supporting the omnichannel experience that luxury customers increasingly demand.

Luxury conglomerate LVMH has invested heavily in CDP technology to unify customer data across their portfolio of brands. This investment supports both cross-selling opportunities and enhanced customer experiences based on comprehensive understanding of customer preferences and history.

Assess Your Luxury E-commerce Technology Readiness

Our proprietary Technology Readiness Assessment evaluates your current stack against scaling requirements. Receive a detailed report with prioritized recommendations and implementation roadmap.

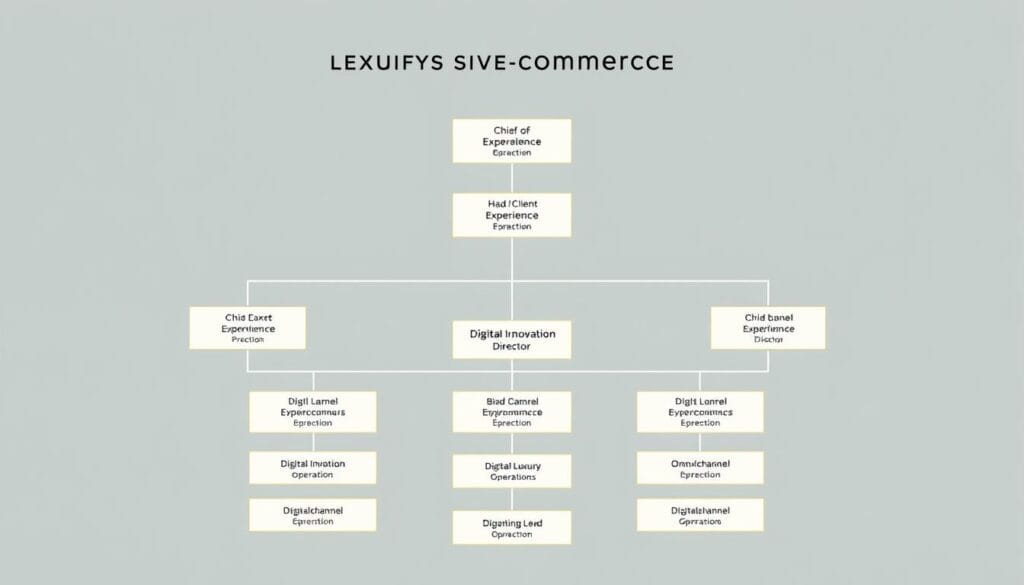

Organizational Readiness for Scaling Luxury E-commerce

Technology alone cannot drive successful scaling. The right organizational structure, capabilities, and culture are equally important for sustainable growth. This section explores the organizational foundations required for luxury e-commerce scaling.

Organizational structure optimized for scaling luxury e-commerce operations

Leadership Alignment

Scaling luxury e-commerce requires alignment between creative leadership (who protect brand integrity) and commercial leadership (who drive growth objectives). This alignment is particularly challenging in luxury organizations where creative directors often hold significant influence over brand decisions.

Successful luxury scaling requires establishing clear guardrails that define the non-negotiable elements of your brand experience. These guardrails provide the framework within which growth initiatives can be pursued without risking brand dilution. For example, Bottega Veneta has maintained strict control over their visual identity and product quality while aggressively expanding their digital presence under creative director Matthieu Blazy and CEO Leo Rongone.

Talent & Capability Development

Scaling luxury e-commerce requires a unique blend of skills that combine luxury sensibility with digital expertise. Building this capability mix typically requires both targeted hiring and internal development. Key roles that support luxury e-commerce scaling include:

- Digital Merchandisers who understand both luxury product storytelling and e-commerce conversion optimization

- Client Experience Managers who can translate traditional luxury service into digital contexts

- Content Strategists who maintain brand voice consistency across expanding touchpoints

- Data Scientists who can extract actionable insights from customer behavior while respecting privacy

Leading luxury groups like Kering have established digital academies to develop these hybrid capabilities across their brand portfolio. For independent luxury brands, strategic partnerships with specialized agencies can supplement internal capabilities during scaling phases.

Agile Operating Models

Traditional luxury operating models often emphasize perfectionism and hierarchical decision-making. While these values remain important for product development and brand governance, they can impede the rapid iteration required for digital scaling. Leading luxury brands are adopting modified agile methodologies that preserve brand control while enabling faster learning cycles.

For example, Gucci has implemented a “squad” model for digital initiatives, where cross-functional teams have significant autonomy within defined brand parameters. This approach allows for rapid experimentation with customer-facing experiences while maintaining centralized control over brand assets and messaging.

Metrics & Performance Management

Effective scaling requires balanced performance metrics that measure both growth outcomes and brand health. Traditional e-commerce metrics like conversion rate and average order value must be complemented by brand-specific measures such as:

- Net Promoter Score segmented by customer value tier

- Brand perception indices among target and adjacent customer segments

- Full-price sell-through percentage as an indicator of brand desirability

- Earned media value as a measure of organic brand interest

These balanced metrics ensure that growth initiatives are evaluated not just on their immediate commercial impact but also on their contribution to long-term brand equity.

Successful luxury scaling requires collaboration between traditional luxury expertise and digital innovation

Future Horizons: Emerging Trends in Luxury E-commerce

As you develop your scaling strategy, it’s important to consider emerging trends that will shape the future of luxury e-commerce. The following developments represent both opportunities and potential disruptions for scaling luxury brands.

Emerging trends reshaping the future of luxury e-commerce

Web3 & Digital Ownership

Blockchain technology and NFTs are creating new models of digital ownership that align with luxury’s emphasis on authenticity and exclusivity. Brands like Louis Vuitton and Gucci have already experimented with NFTs as digital collectibles and authentication mechanisms. As these technologies mature, they offer scaling luxury brands new revenue streams and customer engagement models.

The concept of “phygital” products—physical items with digital components—is particularly relevant for luxury brands. For example, Prada’s Timecapsule NFT collection pairs limited-edition physical products with digital certificates of authenticity and ownership. These innovations extend the luxury experience into digital realms while reinforcing the value of physical craftsmanship.

Metaverse Presence

Virtual worlds and metaverse platforms represent new channels for luxury brand expression and commerce. Balenciaga’s collaboration with Fortnite and Gucci’s Roblox experience demonstrate how luxury brands can create immersive digital environments that extend their reach to new audiences while maintaining creative control.

For scaling luxury brands, metaverse initiatives should be approached as brand-building investments rather than immediate revenue drivers. The most successful examples focus on creating distinctive experiences that translate brand codes into digital contexts rather than simply replicating physical products in virtual form.

Hyper-Personalized Products

Advanced manufacturing technologies are enabling new levels of product personalization at commercially viable scales. Luxury brands like Burberry and Louis Vuitton are exploring on-demand production models that allow customers to customize products beyond traditional monogramming or color selection.

These capabilities align perfectly with luxury’s emphasis on individuality and exclusivity. For scaling DTC brands, offering progressive levels of personalization can create a distinctive value proposition while reducing inventory risk through made-to-order production models.

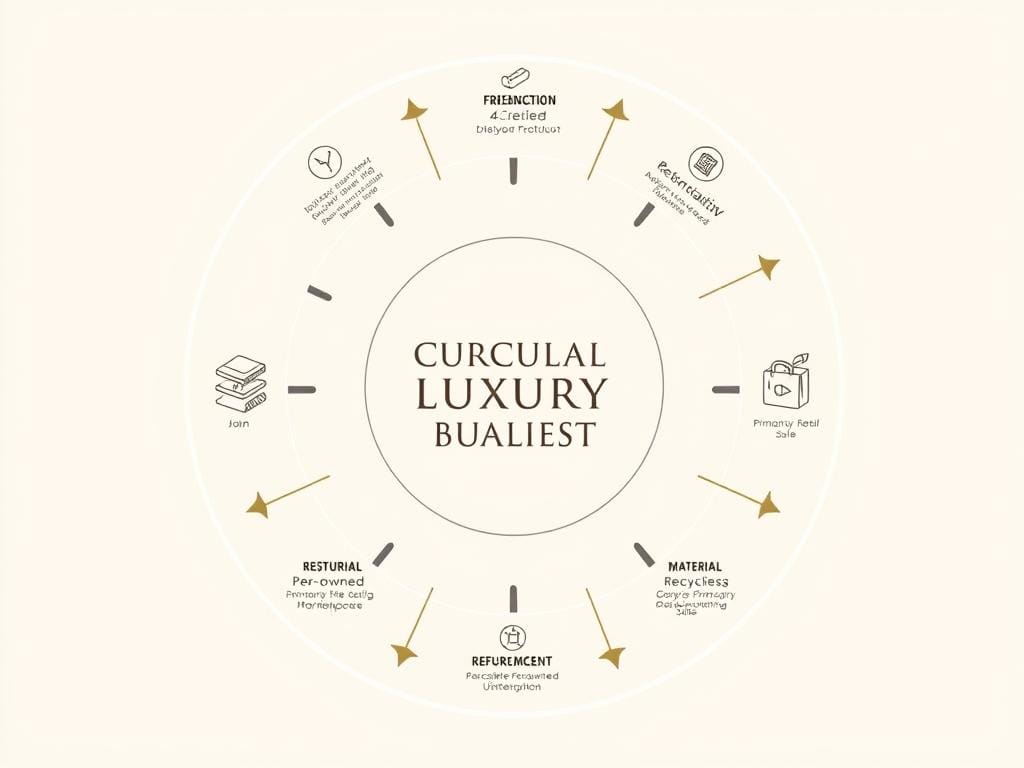

Circular Luxury Models

Sustainability concerns are driving interest in circular business models across the luxury sector. Brands like Stella McCartney and Eileen Fisher have pioneered resale and recycling programs that extend product lifecycles while creating new customer touchpoints. These models are particularly relevant for luxury, where product quality supports multiple ownership cycles.

For scaling luxury brands, circular initiatives can simultaneously address sustainability objectives, create new revenue streams, and attract younger consumers who value responsible consumption. The key is integrating these models into your core business rather than treating them as separate sustainability initiatives.

Circular luxury business models create sustainable growth while preserving brand integrity

Conclusion: Balancing Growth and Brand Integrity

Scaling luxury e-commerce successfully requires a delicate balance between growth ambitions and brand stewardship. The strategies, frameworks, and case studies presented in this article demonstrate that sustainable scaling is possible when approached with intentionality and a clear understanding of your brand’s core values.

The most successful luxury scaling stories share several common elements:

- A clear brand foundation that defines non-negotiable elements of the customer experience

- Technology investments that enable both operational scale and experience differentiation

- Organizational capabilities that blend luxury expertise with digital fluency

- Balanced metrics that measure both commercial outcomes and brand health

- A long-term perspective that prioritizes sustainable growth over short-term gains

As you develop your own scaling strategy, remember that true luxury has always been defined by its ability to transcend transactional relationships and create emotional connections with customers. The digital transformation of luxury doesn’t change this fundamental truth—it simply creates new contexts and opportunities for these connections to flourish.

By approaching scaling with a commitment to both growth and brand integrity, you can build a luxury e-commerce business that delivers exceptional experiences to an expanding customer base while preserving the exclusivity and emotional resonance that define luxury.

Accelerate Your Luxury E-commerce Growth

Our team of luxury e-commerce specialists has helped brands achieve sustainable growth while enhancing their market positioning. Schedule a confidential consultation to discuss your scaling objectives and explore how our frameworks can be tailored to your unique brand.